Medicare Part D: What It Covers, How to Save, and What You Need to Know

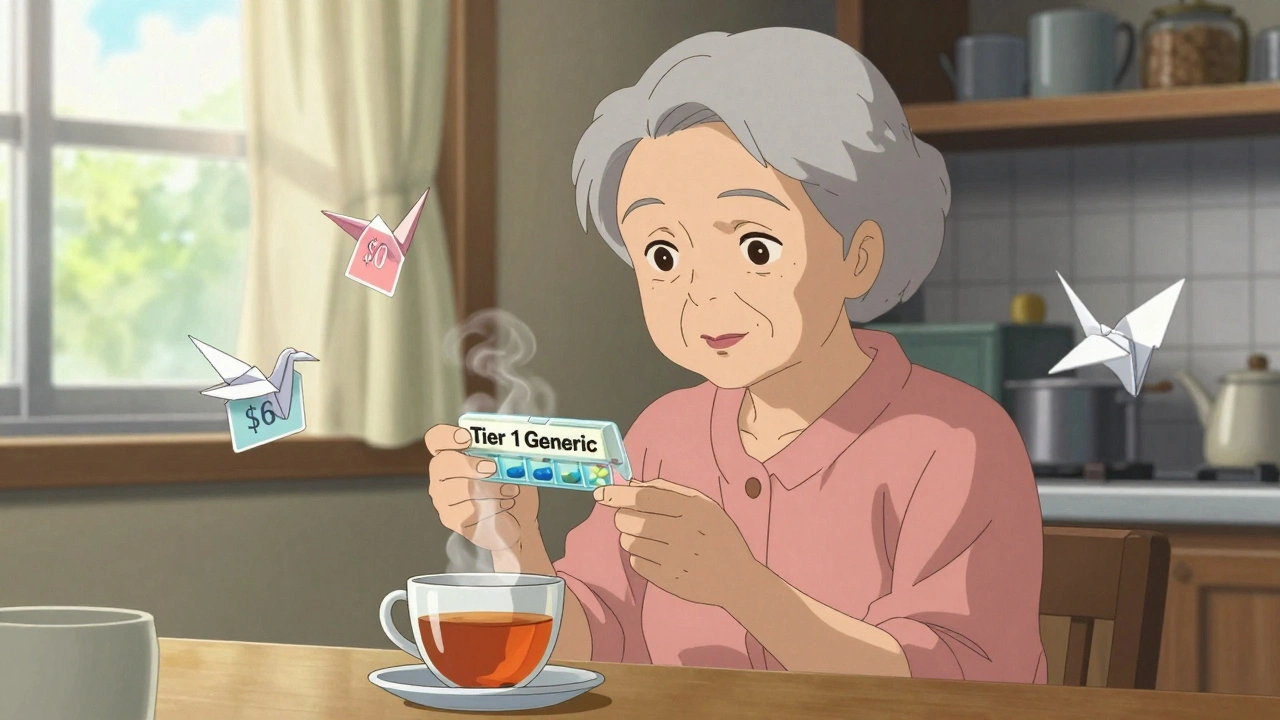

When you’re on Medicare, Medicare Part D, the prescription drug coverage component of Medicare that helps pay for medications. It’s not automatic—you have to pick a plan, and the wrong one can cost you hundreds or even thousands extra each year. Many people think Part D is just about getting pills covered, but it’s really about managing costs over time. That’s why knowing how it works with generic medications, lower-cost versions of brand-name drugs that are just as effective makes a huge difference. A single generic can save you 80% compared to the brand, and over a lifetime, that adds up to tens of thousands.

Part D plans vary wildly in what they cover, how much you pay upfront, and which pharmacies you can use. Some plans have low monthly premiums but high deductibles. Others cover more drugs but charge more each month. And not all plans cover the same Medicare drug plans, private insurance plans approved by Medicare to provide prescription coverage. If you take multiple meds, especially for chronic conditions like high blood pressure or diabetes, your plan’s formulary—the list of covered drugs—can make or break your budget. That’s why checking if your specific drugs are listed, and at what tier, is more important than just picking the cheapest monthly fee.

There’s also the coverage gap, often called the "donut hole." Once you and your plan spend a certain amount on drugs, you pay more out of pocket until you hit a catastrophic threshold. But here’s the thing: Medicare Part D now helps you during the gap. You pay no more than 25% of the cost for both brand-name and generic drugs while in the donut hole. That’s a big change from just a few years ago. Combine that with using generics, asking your pharmacist about Medicare savings, strategies like mail-order pharmacies, manufacturer coupons, or state assistance programs that reduce out-of-pocket drug costs, and you can cut your annual drug spending in half.

And don’t forget the late enrollment penalty. If you don’t sign up when you’re first eligible and you don’t have other creditable drug coverage, you’ll pay extra every month for as long as you have Part D. That penalty is permanent. It’s not a one-time fee—it’s added to your premium forever. So even if you think you don’t take many drugs now, it’s smarter to enroll early. You can always switch plans later during open enrollment.

Below, you’ll find real, practical guides on how to cut drug costs, understand interactions, compare generics, and avoid common mistakes that cost people money. These aren’t theory pieces—they’re based on what people actually deal with when managing prescriptions on Medicare. Whether you’re helping a parent, managing your own meds, or just trying to make sense of the system, you’ll find clear steps to save more and stress less.

Medicare Part D Economics: How Generics Drive Cost Savings for Beneficiaries

Medicare Part D saves billions by using generics, which make up 87% of prescriptions but only 24% of spending. Learn how formularies, copays, and new caps help beneficiaries save money-and what to watch out for.