Medicare Part D isn’t just about giving seniors access to medications-it’s a massive economic engine built around one simple idea: generics save money. And not just a little. Since the program launched in 2006, generic drugs have become the backbone of how Medicare controls spending while still covering what millions of beneficiaries need. In 2023, 87.3% of all Part D prescriptions were for generics. That’s nearly nine out of every ten pills filled. But how does that actually work? And why does it matter so much to your wallet?

How Part D Plans Are Designed to Push Generics

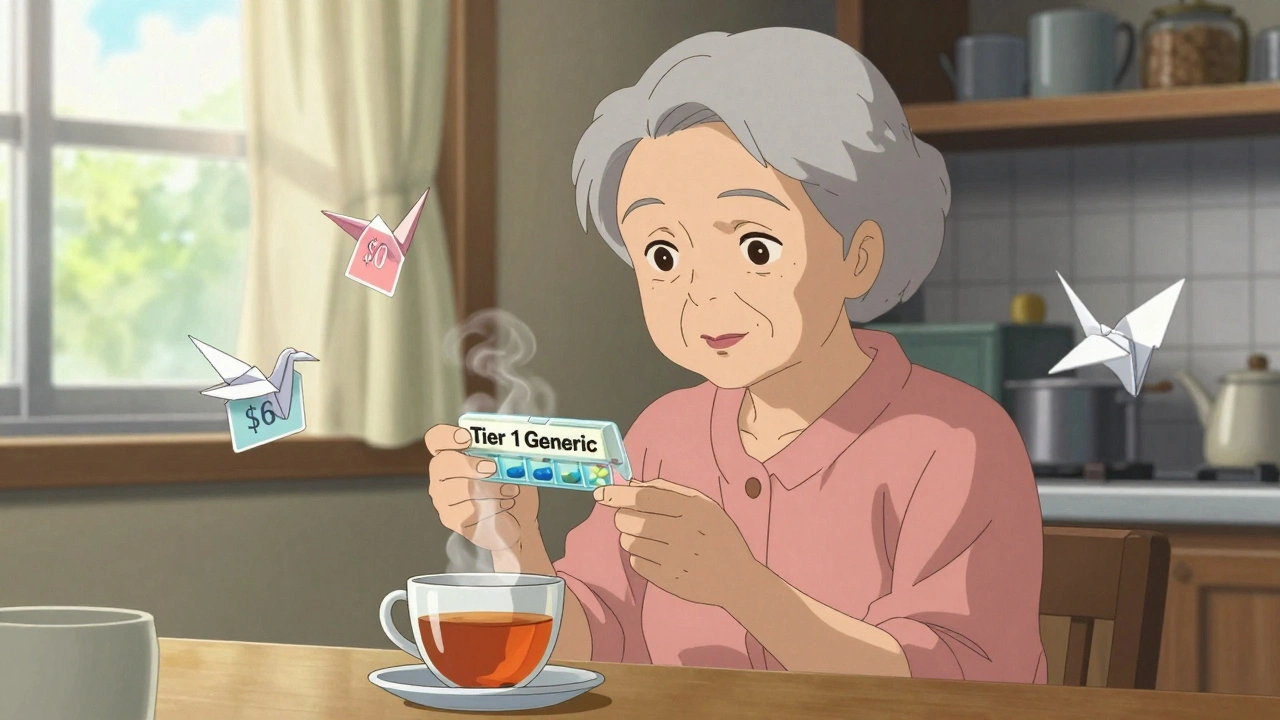

Every Medicare Part D plan-whether it’s a standalone drug plan or part of a Medicare Advantage plan-uses a tiered formulary. Think of it like a pricing ladder. The lowest rung? Preferred generics. These are the cheapest drugs you can get, often with $0 or $5 copays at preferred pharmacies. Tier 2 is regular generics, usually around $15 for a 30-day supply. Then come preferred brand-name drugs, non-preferred brands, and finally, specialty drugs, which can cost hundreds. The system is intentional. Plans are required by CMS to put at least two generic options in each of 148 common drug categories. That means if you’re on a blood pressure med, there’s likely a generic version in Tier 1. And because the copay is so low, most people choose it. In 2024, the average copay for a Tier 1 generic was just $8. The same drug as a brand? That could cost $60 or more. This isn’t random. It’s economics in action. Generics cost Part D plans about $18.75 per prescription on average. Brand-name drugs? Around $156. That’s an 88% difference. So when a plan encourages you to take a generic, it’s not just helping you-it’s saving the whole program money.The Real Cost Difference: Generics vs. Brand Names

Let’s say you take amlodipine, a common blood pressure drug. The generic version? At many plans, it’s $0. The brand name, Norvasc? Around $45 a month. That’s $540 a year in savings-just for one pill. Multiply that across multiple medications, and you’re talking thousands. According to Kaiser Family Foundation data, beneficiaries who stick with generics save between $1,560 and $2,340 per year on average compared to using brand-name drugs. That’s not pocket change. That’s rent money. Or groceries. Or heating bills in the winter. But here’s the catch: not all generics are treated the same. Some specialty generics-like those for autoimmune diseases or rare conditions-can be placed in higher tiers, even though they’re chemically identical to cheaper versions. That’s because the manufacturer might have negotiated a higher price with the plan. It’s legal, but it’s confusing. A 2023 CMS report found that 63% of beneficiaries would pay more if they switched plans without checking the formulary.How the ‘Donut Hole’ and Out-of-Pocket Caps Change the Game

The Part D coverage gap, once called the “donut hole,” used to be a financial trap. Back in 2019, you paid 70% of the cost for brand-name drugs and 44% for generics during this phase. Now? You pay 25% for both. That change, driven by the Bipartisan Budget Act of 2018, made generics even more attractive. And then came the Inflation Reduction Act of 2022. Starting in 2025, your total out-of-pocket spending on drugs hits a cap: $2,000 a year. After that, you pay nothing for the rest of the year. This doesn’t just help people on expensive brand-name drugs-it helps people on multiple generics too. Why? Because even if each generic costs $10, if you’re taking five of them, you’re hitting that cap faster than you think. Once you’re past $2,000, you get all your meds for free. That’s a game-changer for low-income seniors who used to skip doses to stretch their budget.

Who’s Making the Generics? And Why It Matters

Three companies-Teva, Mylan, and Sandoz-control over 60% of the generic drug market for Medicare Part D. That kind of consolidation means fewer players setting prices. But it also means more stability. When one company lowers its price, others often follow. The Inflation Reduction Act added another layer: drugmakers must now pay rebates if they raise prices faster than inflation. In 2023, 14.7% of generic drugs actually got cheaper. That’s rare. For decades, generic prices crept up year after year. Now, they’re starting to go down. This matters because when a generic drops in price, the plan saves money-and passes some of that savings to you. Some plans now offer $0 copays on the most common generics. SilverScript, for example, scored 4.6 out of 5 stars in 2023, mostly because of its low generic prices.Why Some People Still Skip Their Meds

Even with all these savings, 32% of low-income Medicare beneficiaries still skip doses because they can’t afford them. Why? Because the system still asks you to pay 25% of the cost during the initial coverage phase. That’s fine if your drug costs $10. But if you’re on a specialty generic that costs $120, you’re paying $30 out of pocket every month. That’s still too much for someone on a fixed income. Some people don’t realize they can ask for a coverage determination. If a generic makes you sick or doesn’t work, you can request your plan cover the brand-name version instead. CMS approves these requests 78% of the time. You just have to ask.

How to Make Sure You’re Getting the Best Deal

Every year, between October 15 and December 7, you can switch Part D plans. That’s your chance to find a better deal. Here’s what to do:- Go to Medicare.gov’s Plan Finder and enter your medications.

- Sort by “lowest total cost” and check the formulary tiers.

- Look for plans with $0 copays on your Tier 1 generics.

- Check if your drugs require prior authorization-avoid plans that do this for generics.

- Don’t assume your current plan is still the best. 18% of complaints to CMS in 2023 were about formulary changes mid-year.

The Bigger Picture: Why Generics Are Essential to Part D’s Survival

Part D cost $198.4 billion in 2023. But generics only accounted for $47.8 billion of that-just 24% of total spending. The other 76%? Brand-name drugs, which made up only 13% of prescriptions. Without generics, Part D would be unaffordable. The Congressional Budget Office estimates that generic use saves the federal government $14.2 billion every year in subsidies and catastrophic payments. That’s money that keeps the program running. Experts agree: if generic use keeps rising-projected to hit 91.5% by 2030-Part D will stay solvent for decades. The program’s trust fund is projected to last until 2093, but only if we keep choosing generics over brands.What’s Next for Generics in Medicare Part D

Starting January 1, 2025, drug manufacturers will have to give extra discounts on certain drugs during both the initial coverage phase and the catastrophic phase. This is called the Manufacturer Discount Program. It’s designed to make generics even cheaper and more accessible. Also, CMS now requires every therapeutic category to have at least one generic available without prior authorization. That means no more delays or paperwork just to get a basic drug. The bottom line? Generics aren’t just cheaper-they’re the reason Medicare Part D still works. They’re the quiet heroes of the system. And if you’re on Part D, choosing them isn’t just smart. It’s essential.Are all generic drugs the same as brand names?

Yes, by law. Generic drugs must contain the same active ingredients, dosage, strength, and route of administration as the brand-name version. They’re tested to be equally effective and safe. The only differences are in inactive ingredients like fillers or dyes, which don’t affect how the drug works. Some people report feeling different on a generic, but that’s often due to placebo effect or changes in other health factors.

Why do some generics cost more than others?

It’s not about the drug-it’s about the plan. Two identical generics can be priced differently depending on which manufacturer the plan negotiated with. One plan might have a deal with Teva for $5, while another has a deal with a smaller maker for $15. Also, some plans put certain generics in higher tiers to push you toward a preferred version. Always check the tier, not just the name.

Can I switch from a brand to a generic if my doctor prescribed the brand?

Yes, but only if your doctor allows it. Pharmacists can automatically substitute generics unless your prescription says “dispense as written” or “no substitution.” If you’re concerned about switching, talk to your doctor. They can write the prescription to allow substitution or help you request a coverage determination if the generic doesn’t work for you.

Do all Medicare Part D plans cover the same generics?

No. Each plan has its own formulary, which means the list of covered drugs and their tiers can vary. A drug covered in Tier 1 on one plan might be in Tier 3 on another. That’s why it’s critical to compare plans every year during enrollment. Use the Medicare Plan Finder tool to enter your exact medications and see which plan gives you the lowest total cost.

What if I can’t afford my generic even with a low copay?

You may qualify for Extra Help, a federal program that lowers your Part D costs. If your income is below $21,870 (individual) or $29,520 (couple) in 2025, you could pay as little as $0 for generics. Apply through Social Security or your state Medicaid office. Even if you don’t think you qualify, it’s worth checking-many people miss out because they assume they earn too much.

val kendra

Generics saved my dad’s life last year. He was on three meds-amlodipine, metformin, and lisinopril. Switched to generics, went from $420/month to $45. He started eating better, walking more, even took a cruise with his grandkids. Don’t let anyone tell you generics are ‘inferior.’ They’re just cheaper because Big Pharma isn’t lining their pockets with your co-pays.

Jenny Rogers

It is, of course, profoundly disingenuous to frame this as a victory for the American public when the entire pharmaceutical supply chain remains oligopolistic, and the real beneficiaries are private insurers who pocket the savings while beneficiaries are still subjected to tiered formularies that function as de facto rationing mechanisms. The system is not designed to serve patients-it is designed to optimize profit margins under a veneer of compassion.

Jake Deeds

Oh wow, someone actually wrote a thoughtful piece about generics? I’m touched. I thought we’d all just be yelling about insulin prices forever. Still, it’s kind of sad that the only reason this works is because we’ve been conditioned to accept ‘$0 copay’ as a miracle instead of demanding real price controls. But hey, at least we’re not all dying from hypertension… yet.

Isabelle Bujold

One thing people don’t talk about enough is how generic manufacturers in India and China are now dominating the market, and while the drugs are FDA-approved, the supply chain is incredibly fragile. Remember the heparin contamination scandal? Or the recent shortage of generic levothyroxine because of a single plant shutdown? We’ve outsourced our medication security to a handful of factories overseas, and if geopolitics shift even slightly, millions of seniors could be left without their meds. The savings are real-but so are the risks.

John Filby

Just switched my plan last month and got my blood pressure med for $0. Like, zero. I cried a little. Not because I’m emotional, but because I didn’t think it was possible anymore. Also, I used the Plan Finder and saved $500. Best 17 minutes of my year.

Heidi Thomas

Generics are fine if you don’t mind getting the same active ingredient but different fillers that make you bloated, dizzy, or break out in hives. My doctor says they’re identical but my body says otherwise. They’re not the same. Stop pretending they are. The FDA doesn’t test for how you feel, just if the molecule is there.

Dematteo Lasonya

It’s worth noting that the 25% coinsurance during the initial coverage phase still creates a significant barrier for low-income beneficiaries, especially when multiple generics are involved. Even at $10 per pill, five medications equals $150/month before reaching the deductible. The $2,000 out-of-pocket cap is a step forward, but it’s too late for those who’ve already skipped doses or maxed out credit cards to afford their meds.

Rachel Bonaparte

Let’s be real-this whole system is a corporate puppet show. The same companies that make brand-name drugs also own the generics. Teva, Sandoz, Mylan-they’re all subsidiaries of bigger pharma giants. They just repackage the same pills under a different label and call it a ‘savings.’ The government lets them do this because they’re lobbying harder than your uncle at a BBQ. You’re not saving money-you’re just paying the same people less visibly.

Carolyn Ford

And yet… you’re still being forced to jump through hoops. Prior auth for generics? Really? If it’s chemically identical, why do you need permission? This isn’t healthcare-it’s a bureaucratic obstacle course designed to make you give up. I’ve seen people die because they couldn’t fight the system. And now you’re telling me to ‘use the Plan Finder’ like it’s a game? It’s not a game. It’s survival.

George Graham

I’ve worked with seniors for 15 years. The ones who switch to generics don’t just save money-they gain peace of mind. No more choosing between meds and groceries. No more skipping doses because they’re scared. I’ve watched people breathe easier, walk longer, and reconnect with their families. It’s not glamorous. But it’s real. And it matters.

Rudy Van den Boogaert

My grandma takes six generics. She’s 82. Last year she paid $1,200 out of pocket. This year? $210. She doesn’t know what a formulary is, but she knows her pills cost less. She calls them ‘the cheap ones’ and says they taste the same. That’s all she needs to know.

Ashley Elliott

Just want to say: if you’re on Medicare and you haven’t checked your plan during open enrollment this year… please, please, please do it. Even if you think you’re fine. My neighbor thought she was locked in-ended up paying $180/month for a generic that was $0 on another plan. She didn’t know until her pharmacist told her. You don’t have to be an expert. Just spend 20 minutes on Medicare.gov. It’s the easiest money you’ll ever save.