Medicare Formularies: What Drugs Are Covered and How to Save

When you’re on Medicare formularies, the list of prescription drugs covered by your Medicare Part D plan. Also known as drug lists, these formularies determine what medications you can get at a lower price — or not at all. If you take even one regular prescription, your formulary directly affects your wallet. Not all drugs are treated the same. Some are on the lowest tier with the cheapest copay. Others require prior approval, step therapy, or aren’t covered at all. The difference between a drug being on or off your formulary can mean hundreds — or thousands — of dollars a year.

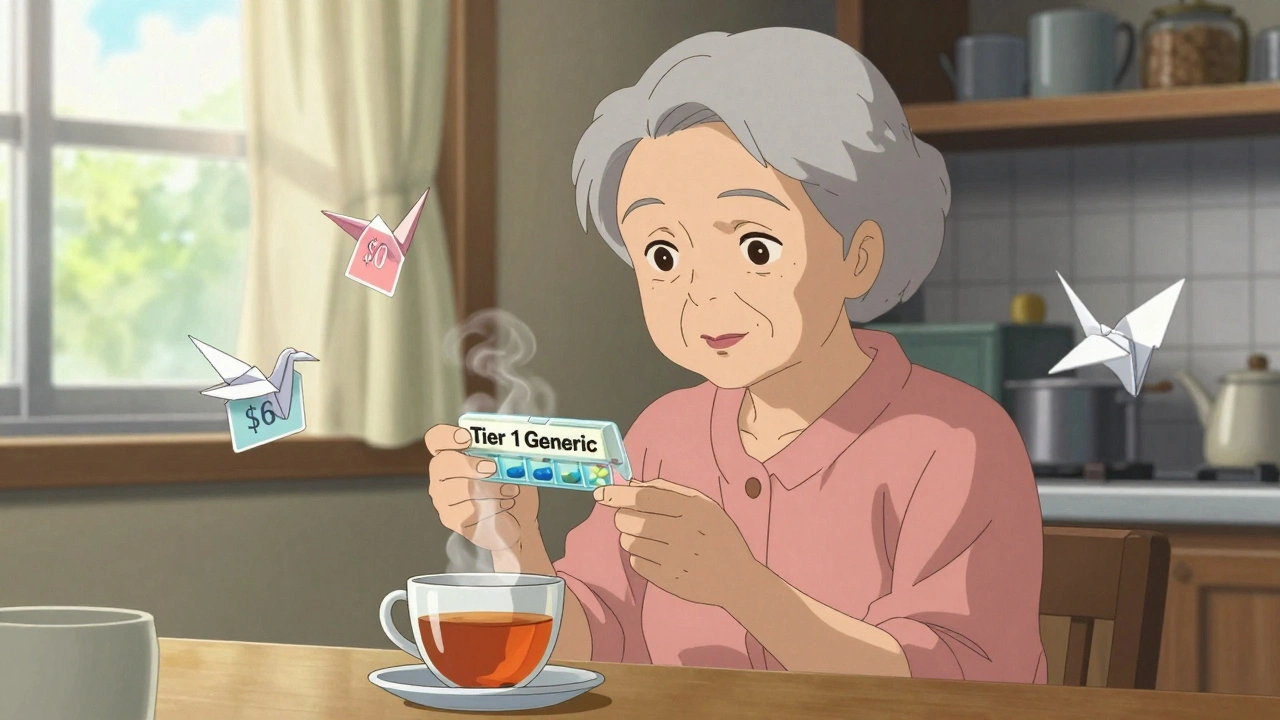

Understanding how formulary tiers, the ranking system that determines how much you pay for each drug works is key. Tier 1 usually includes generic drugs like metformin or lisinopril — often under $10 a month. Tier 2 has preferred brand-name drugs. Tier 3 and 4? Those are non-preferred brands and specialty meds, sometimes costing over $100. And if a drug’s not on the list? You pay full price unless you appeal. That’s why checking your plan’s formulary every year during Open Enrollment isn’t optional — it’s essential. Many people don’t realize their plan changes its formulary every January. A drug that was covered last year might now require prior authorization, or worse, be dropped entirely.

Medicare Part D, the prescription drug coverage component of Medicare is offered through private insurers, so each plan has its own formulary. That means two people on Medicare can have wildly different drug coverage — even if they live next door. Some plans favor generics. Others include more brand-name drugs but charge higher premiums. And then there’s the generic drugs, identical to brand-name drugs but often 80% cheaper factor. Nearly every formulary puts generics first for a reason: they save money without sacrificing effectiveness. But you have to ask for them. Your pharmacist won’t automatically swap your brand for a generic unless you say yes.

Don’t just assume your current meds are covered. Look up your exact drugs — including dosages — on your plan’s website or call customer service. If something’s not covered, ask if there’s a similar drug on formulary. Ask about prior authorization steps. Ask if a therapeutic alternative exists. And if you’re on multiple meds, check for interactions — especially with fiber supplements, potassium-rich foods, or common OTC pain relievers. Many of the posts below walk through exactly how to do this without getting lost in jargon.

What you’ll find here isn’t theory. It’s real-world advice from people who’ve been there: how to fight a denial, how to time your meds to avoid interactions, how to spot when an authorized generic is available, and how to use drug interaction checkers before you fill a new prescription. You’ll see how patent laws affect when generics hit the market, how international pricing impacts what’s available in the U.S., and why some drugs disappear from formularies overnight. This isn’t about memorizing rules. It’s about knowing what to ask, when to push back, and how to get the drugs you need without overpaying.

Medicare Part D Economics: How Generics Drive Cost Savings for Beneficiaries

Medicare Part D saves billions by using generics, which make up 87% of prescriptions but only 24% of spending. Learn how formularies, copays, and new caps help beneficiaries save money-and what to watch out for.