Formulary Tier Checker

When your insurance plan changes the drug list, it’s not just a paperwork update-it can mean your monthly pill cost jumps from $30 to $300 overnight. This isn’t rare. In 2023, 12.7% of Medicare beneficiaries faced a formulary change that affected their medication, and nearly one in three of those people struggled to get the same drug or an affordable alternative. If you take even one prescription regularly, you need to understand how formularies work, how they change, and what to do when they do.

What Is a Formulary, Really?

A formulary is the official list of drugs your insurance will pay for. It’s not a suggestion. It’s a rulebook. Every plan-Medicare Part D, employer insurance, Medicaid-uses one. These lists are made by teams of doctors and pharmacists who decide which medications offer the best balance of safety, effectiveness, and price. They don’t pick drugs because they’re popular. They pick them because they work, and because cheaper versions exist that do the same job. Most formularies are split into tiers. Think of them like levels in a video game, but instead of unlocking powers, you’re unlocking lower prices.- Tier 1: Generic drugs. These are the cheapest. You’ll often pay $0-$10 per prescription.

- Tier 2: Preferred brand-name drugs. These are name-brand meds the plan likes because they’re proven and cost-effective. Copays range from $25-$50.

- Tier 3: Non-preferred brand-name drugs. These are more expensive. You’ll pay $50-$100. Your plan wants you to try Tier 2 first.

- Tier 4/5: Specialty drugs. These are for serious conditions-cancer, MS, rheumatoid arthritis. Costs can be $100+, or you might pay 30-50% of the drug’s total price.

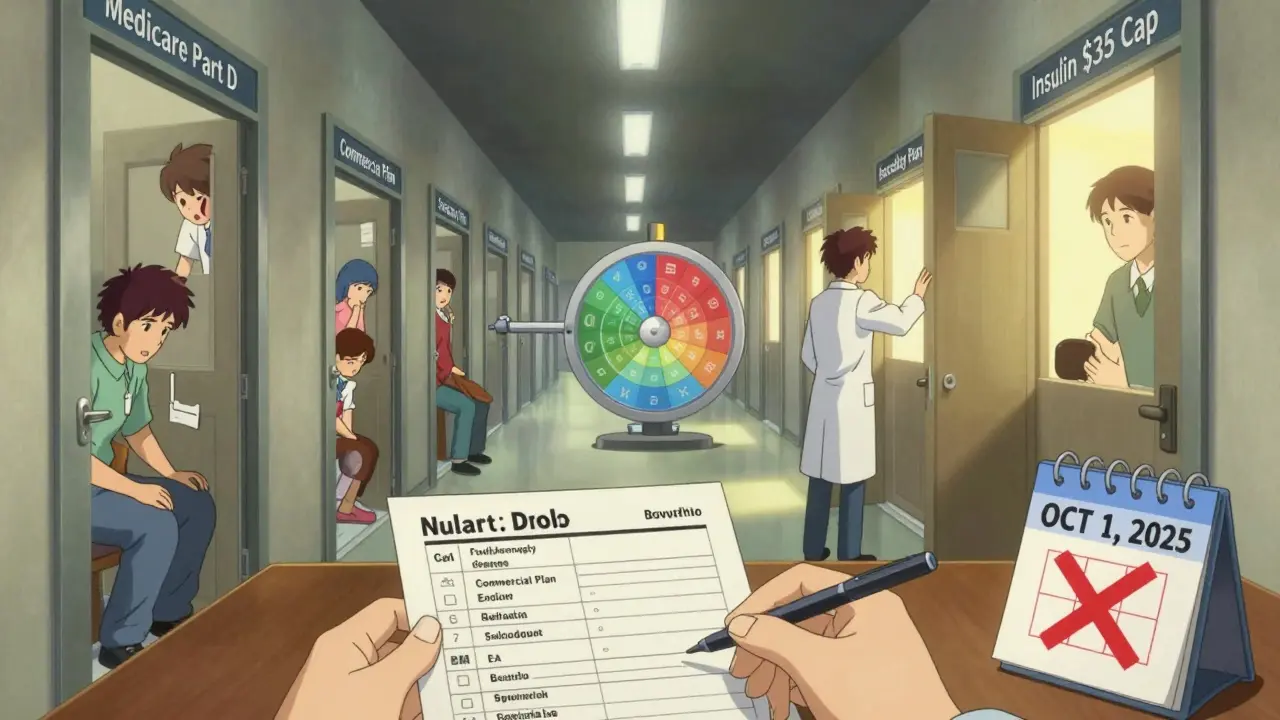

Medicare Part D plans must use 4 or 5 tiers. Most commercial plans use 3. The higher the tier, the more you pay-and the more likely your plan will require prior authorization or step therapy before approving the drug.

Why Do Formularies Change?

Formularies aren’t set in stone. They change every year, usually on January 1. But they can also change mid-year-and you might not know until your pharmacy says, “We can’t fill this.” Here’s why:- New generic versions hit the market. If a cheaper generic becomes available, your plan will push you to switch.

- A drug gets recalled or flagged. If the FDA warns about safety issues, the plan removes it fast.

- Drug prices spike. If a brand-name drug costs too much, the plan may move it to a higher tier or drop it entirely.

- Pharmacy benefit managers (PBMs) negotiate deals. CVS Caremark, Express Scripts, and OptumRx control 87% of commercial formularies. They push for drugs they get the biggest discount on-even if it’s not your doctor’s first choice.

Medicare plans must notify you 60 days before removing a drug. Commercial plans only need 30 days. That’s not much time to scramble.

What Happens When Your Drug Gets Removed?

Let’s say your blood pressure med, Lisinopril, was on Tier 2. Now it’s gone. Your plan says, “Try Losartan instead.” It’s a different drug. Same class. Often works fine. But what if it gives you a cough? Or makes you dizzy? What if you’ve been on Lisinopril for 10 years and it’s the only thing that kept your kidneys stable? You have options.- Request an exception. Your doctor can submit a formal request asking the plan to cover your original drug. The most common reasons for approval? You tried the alternative and it didn’t work (47% of approved cases), or you had a bad reaction to it (32%).

- Appeal the decision. If your exception is denied, you can appeal. Medicare gives you 60 days to file. Commercial plans vary, but most allow at least one level of appeal.

- Switch to a different drug. Sometimes, the alternative is actually better. A 2022 JAMA study found that step therapy-trying cheaper drugs first-reduced unnecessary high-cost prescriptions by 18% without hurting outcomes.

- Change plans. If this keeps happening, you may need to switch during Medicare’s Open Enrollment (October 15-December 7) or during a Special Enrollment Period if you qualify.

Don’t wait until your prescription runs out. Start the process as soon as you hear about a change. CMS data shows 78% of doctor-submitted exceptions get approved within 72 hours.

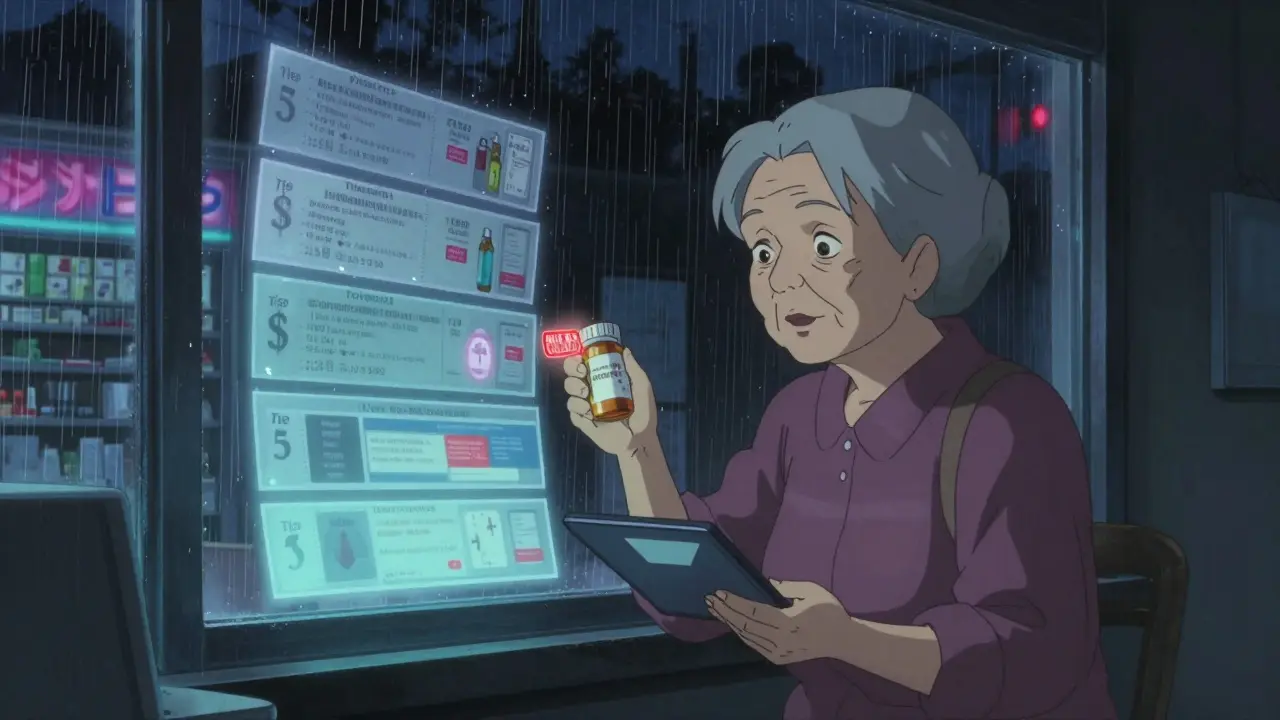

How to Check Your Formulary Before It’s Too Late

Most people don’t check their formulary until something breaks. That’s a mistake. Here’s your simple checklist:- Find your plan name. Look at your insurance card. Write it down.

- Go to your insurer’s website. Search for “formulary,” “drug list,” or “prescription coverage.”

- Download the current formulary PDF. Don’t rely on search tools. PDFs are updated, and search functions are often outdated.

- Search for every drug you take. Include generics and brand names. Note the tier and any restrictions (prior auth, step therapy).

- Check the effective date. Is this the 2025 plan? Or still 2024? If it’s before October, it’s likely outdated.

Pro tip: Bookmark the formulary page. Set a calendar reminder for October 1 each year. That’s when new formularies are published for the next plan year.

For Medicare users, use the Medicare Plan Finder tool. It’s clunky, but it’s official. Only 3.2 out of 5 stars from users-but it’s the only one that’s accurate.

Special Cases: Cancer, Diabetes, Mental Health

Some drugs are protected. Medicare Part D must cover all drugs in six categories: antidepressants, antipsychotics, immunosuppressants, HIV/AIDS meds, anticonvulsants, and cancer drugs. Commercial plans don’t have to. That’s a big difference. If you take insulin, you’re lucky. Since January 2023, Medicare Part D plans can’t charge more than $35 per month for insulin. Almost all plans removed cost-sharing for it. That’s a win. But for other specialty drugs-like those for multiple sclerosis or rare genetic conditions-coverage is shaky. In 2023, a cancer patient lost access to her drug for 21 days because her plan removed it without warning. She had to get emergency help from a nonprofit. If you’re on a high-cost drug, keep a paper copy of your prescription, your doctor’s note, and your formulary page. When you call your insurer, have them ready.What’s Changing in 2025?

Big shifts are coming.- $2,000 out-of-pocket cap for Medicare Part D. Starting in 2025, you won’t pay more than $2,000 a year for drugs, no matter how expensive they are. This will force plans to lower restrictions on high-cost meds.

- Drug price negotiations. Starting in 2026, Medicare will negotiate prices for 10 high-cost drugs. That could mean formularies shift again-possibly adding cheaper versions or removing expensive ones.

- More AI in formulary decisions. Pharmacy benefit managers are using AI to predict which drugs will be most cost-effective. That’s good if it finds cheaper alternatives. Bad if it ignores real-world patient data.

These changes are meant to help. But they also mean more uncertainty. The number of formulary restrictions is projected to rise 15-20% over the next five years as drug prices climb.

Real Stories: What Happens When You Don’t Prepare

One user on Reddit, u/RetireeInFlorida, wrote: “My heart med went from Tier 2 to Tier 4. My copay jumped from $45 to $450. I spent three weeks calling, faxing, begging. Got approved-but lost a month of treatment.” Another, on the Medicare Rights Center forum, said: “My diabetes drug was removed. My doctor filed an exception. Approved in 48 hours. No extra cost.” The difference? One person waited. The other acted. Consumer Reports found that 68% of Medicare beneficiaries couldn’t find their formulary on their insurer’s website. That’s not a glitch. That’s a design flaw. Insurance companies don’t make it easy to find this info because they know most people won’t look.How to Stay in Control

You can’t control your insurer. But you can control your actions.- Check your formulary every October. Don’t wait for a letter. Don’t wait for a pharmacy call. Do it yourself.

- Keep a printed copy of your current meds and tiers. Bring it to every doctor visit.

- Ask your pharmacist: “Is this drug still on the formulary?” They know the list better than you do.

- Ask your doctor: “If my drug gets removed, what’s the next best option?” Get it in writing.

- Sign up for personalized alerts. Some plans now send emails or texts if a drug you take changes. Turn them on.

- Know your rights. You can appeal. You can request exceptions. You are not powerless.

Medication changes are stressful. But they’re not inevitable. With the right information and timing, you can avoid the $450 surprise. You can keep your treatment steady. You can protect your health-and your wallet.

What happens if my insurance removes my medication from the formulary?

If your drug is removed, your pharmacy will tell you at the counter. You can ask your doctor to file an exception request-most are approved within 72 hours if you have medical documentation showing the alternative didn’t work or caused side effects. If denied, you can appeal. Don’t stop taking your meds. Ask for a temporary 30-day supply while you work it out.

Can I switch plans if my medication gets dropped?

Yes-but timing matters. Medicare beneficiaries can switch during Open Enrollment (October 15-December 7) for changes starting January 1. If you’re affected mid-year, you may qualify for a Special Enrollment Period if you lose coverage or your drug is removed. Commercial plan members can usually switch during their annual renewal window or if they experience a qualifying life event.

Are generic drugs always safe and effective?

Yes. The FDA requires generics to be bioequivalent to brand-name drugs-they must have the same active ingredient, strength, dosage form, and route of administration. They’re tested to work the same way. The only differences are inactive ingredients (like fillers), which rarely affect most people. If you’ve had no issues with generics before, there’s no reason to assume you will now.

Why do some drugs require prior authorization?

Prior authorization means your doctor must prove the drug is medically necessary before the plan will pay. It’s used for expensive drugs, drugs with safety risks, or when cheaper alternatives exist. It’s not meant to block care-it’s meant to prevent unnecessary spending. But it can delay treatment if paperwork isn’t filed quickly.

How do I know if my plan’s formulary is up to date?

Check the effective date on the formulary document. Most plans update annually on January 1. If you’re viewing a formulary before October, it’s likely for the current year. For 2025 coverage, wait until October 15-December 7 to review the new list. Never trust a website search tool-always download the official PDF.

Can I get my drug covered if it’s not on the formulary at all?

Yes, but it’s harder. You’ll need a doctor’s letter explaining why no covered drug works for you-often due to allergies, past failures, or severe side effects. For rare diseases or specialty drugs, nonprofit patient assistance programs or manufacturer coupons may help cover costs while you wait for approval.

Uche Okoro

Let’s cut through the performative wellness rhetoric: formularies are not medical documents-they’re actuarial instruments disguised as clinical guidelines. PBMs leverage tiered formularies to externalize cost volatility onto patients while maintaining margin integrity. The bioequivalence myth is perpetuated by regulatory capture; FDA equivalence thresholds permit ±20% variation in AUC and Cmax, which is clinically significant for narrow-therapeutic-index drugs like warfarin or levothyroxine. When your insurer swaps lisinopril for losartan, they’re not optimizing care-they’re optimizing rebate arbitrage. The 78% exception approval rate? That’s not a feature-it’s a bug in the system designed to create the illusion of patient agency while maintaining structural coercion.

Ryan W

USA still letting private insurers dictate life-or-death drug access? Pathetic. In Canada, we have national formularies-no tier nonsense, no prior auth nightmares. You get the drug your doctor prescribes. Period. This whole ‘step therapy’ nonsense is just corporate greed wrapped in clinical jargon. If your insurance won’t cover your meds, they shouldn’t be allowed to operate. We don’t let banks decide who gets insulin. Why do we let PBMs?

Allie Lehto

OMG I JUST REALIZED I NEVER CHECKED MY FORMULARY 😭 I’ve been on metformin for 8 years and I just assumed it was always gonna be covered… I’m gonna cry now. My pharmacist didn’t even tell me anything!! 😭😭😭

Rakesh Kakkad

Dear colleagues, I must emphasize the structural inefficiencies inherent in the current pharmaceutical benefit management paradigm. The convergence of monopolistic PBM consolidation and algorithmic formulary optimization has created a transactional healthcare environment where patient outcomes are subordinated to cost-containment metrics. The FDA’s bioequivalence standard, while technically adequate, fails to account for inter-individual pharmacokinetic variance, particularly in geriatric and polypharmacy populations. I urge all stakeholders to demand transparency in rebate structures and to advocate for formulary governance that prioritizes clinical utility over financial incentive.

George Rahn

They want you to think this is about healthcare. It’s not. It’s about control. These PBMs are foreign-owned hedge funds in suits who’ve turned your medicine cabinet into a profit center. We don’t need more ‘tips’-we need to burn the whole system down. Medicare Part D was a gift to Big Pharma. Now they’re using it to gouge seniors. And you? You’re the one getting squeezed between $35 insulin and $450 heart meds. Wake up. This isn’t a system failure. It’s by design.

Ashley Karanja

I just want to say how deeply this resonates with me. I’m a nurse practitioner and I see this every single day-patients crying because their antidepressant was moved to Tier 4, or their MS drug got pulled mid-cycle. The emotional toll is staggering. I’ve had patients skip doses because they can’t afford it, and then end up in the ER. The system is designed to make you feel powerless, but you’re not. You have rights. You have voice. I always tell my patients: print your formulary, keep a binder, write down every call you make, and never, ever accept ‘no’ without an appeal. You’re not a burden-you’re a patient. And you deserve better. 💙

Karen Droege

Let me tell you what happened to my neighbor-78-year-old retired teacher, on lisinopril since 2012. One day, pharmacy says ‘Sorry, not covered.’ She calls her doc, they file exception, gets denied. She appeals. Takes 21 days. She goes without. Her BP spikes. She falls. Breaks hip. Now she’s in rehab. All because some PBM got a better deal on losartan. This isn’t healthcare. This is corporate manslaughter. And if you’re not screaming about this, you’re part of the problem. We need a national formulary. Now. #MedicareForAll

Shweta Deshpande

Hi everyone, I just wanted to say you're not alone. I was in the same spot last year when my diabetes drug got pulled. I was scared too. But I called my doctor, asked for a backup, and found out my plan had a cheaper generic I didn't even know about. It worked just fine! I even saved $20 a month. It's scary, but you can do it. Take a deep breath, write things down, and reach out. There are people who want to help. 💪❤️

Aishah Bango

People who don’t check their formularies are just asking for trouble. If you’re too lazy to read a PDF once a year, don’t complain when your meds disappear. This isn’t a conspiracy-it’s your responsibility. Stop blaming insurers and start being an adult. I’ve been on the same meds for 15 years. I check every October. Done. No drama. No panic. You can too.

Faisal Mohamed

It’s ironic that we treat drug access like a commodity when it’s literally life-sustaining. The AI-driven formularies are the new eugenics-algorithms deciding who gets to live based on cost-per-milligram. We’ve outsourced medical ethics to Excel sheets. And now we’re surprised when people die because their insulin got downgraded? This isn’t innovation. It’s institutional cruelty wrapped in machine learning.

SWAPNIL SIDAM

My father had to switch from his heart medicine last year. We didn't know until the pharmacy said no. He was confused, scared. We called, we waited, we cried. But we didn't give up. We got it approved. Just keep going. One step at a time. You are not alone. 🙏