When you pick up a prescription for generic sertraline or metformin, you probably don’t think about how the price got so low. Most people assume it’s just the free market at work - and they’re right. But behind that low price is a complex system of government rules, regulatory shortcuts, and aggressive competition that keeps generic drugs affordable. Unlike branded drugs, which can cost hundreds or even thousands of dollars, generic versions often cost less than $10 a month. And here’s the thing: government price controls aren’t what made that happen. In fact, they’re mostly absent.

Why Generic Drugs Are So Cheap - And Why the Government Doesn’t Set Their Prices

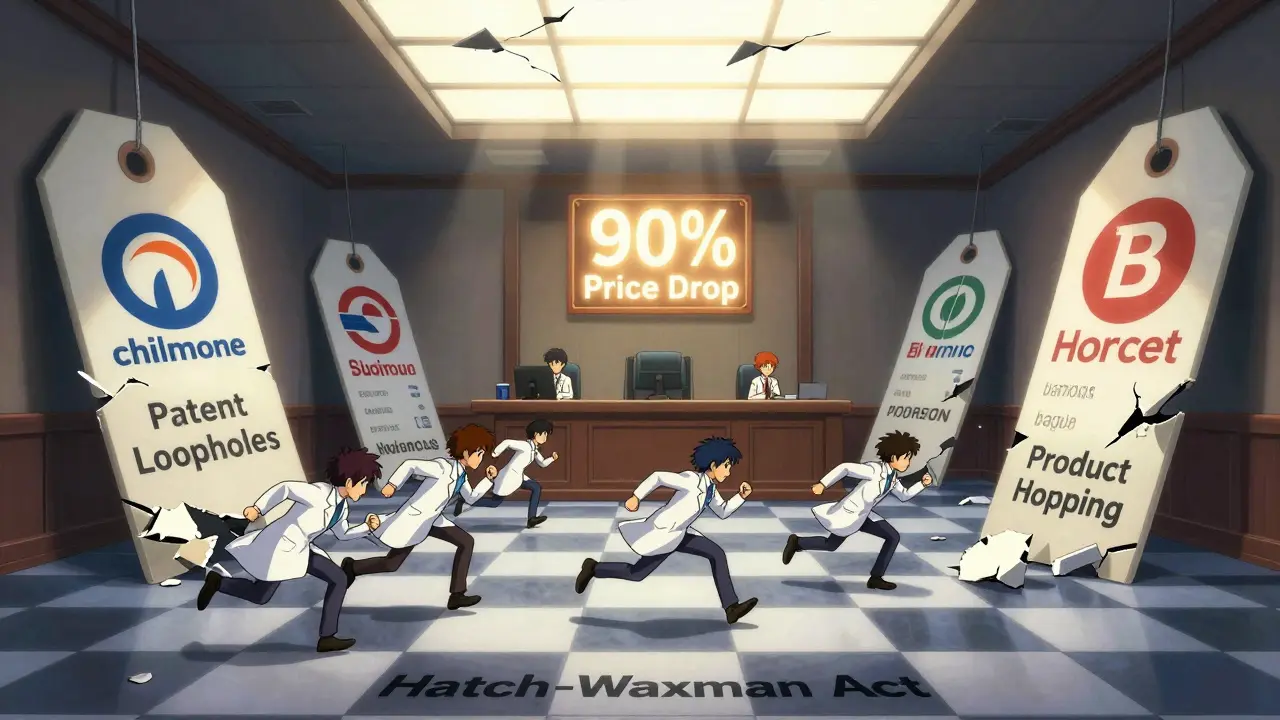

Generic drugs aren’t cheap because the government slapped a price cap on them. They’re cheap because the system was built to force competition. The Hatch-Waxman Act of 1984 created the Abbreviated New Drug Application (ANDA) process, which lets generic manufacturers skip expensive clinical trials. All they have to prove is that their version works the same as the brand-name drug. That cuts development costs from $2.6 billion down to $2-3 million. Suddenly, dozens of companies can enter the market.

Once one generic hits, prices start falling. By the time three or four companies are selling the same drug, the price drops to 10-15% of the original brand price. The FDA found that within two years of multiple generics entering the market, prices fall by 90%. That’s not regulation - that’s capitalism working the way it’s supposed to.

That’s why the Inflation Reduction Act of 2022, which lets Medicare negotiate drug prices, excludes generics. The Department of Health and Human Services made it clear: generics already have enough competition to keep prices low. The same goes for the 2025 Most-Favored-Nation Executive Order targeting drugs like Ozempic - it doesn’t touch generics because there’s no need.

The Real Government Role: Speeding Up Approval and Stopping Anti-Competitive Tactics

If the government isn’t setting prices, what is it doing? It’s removing roadblocks.

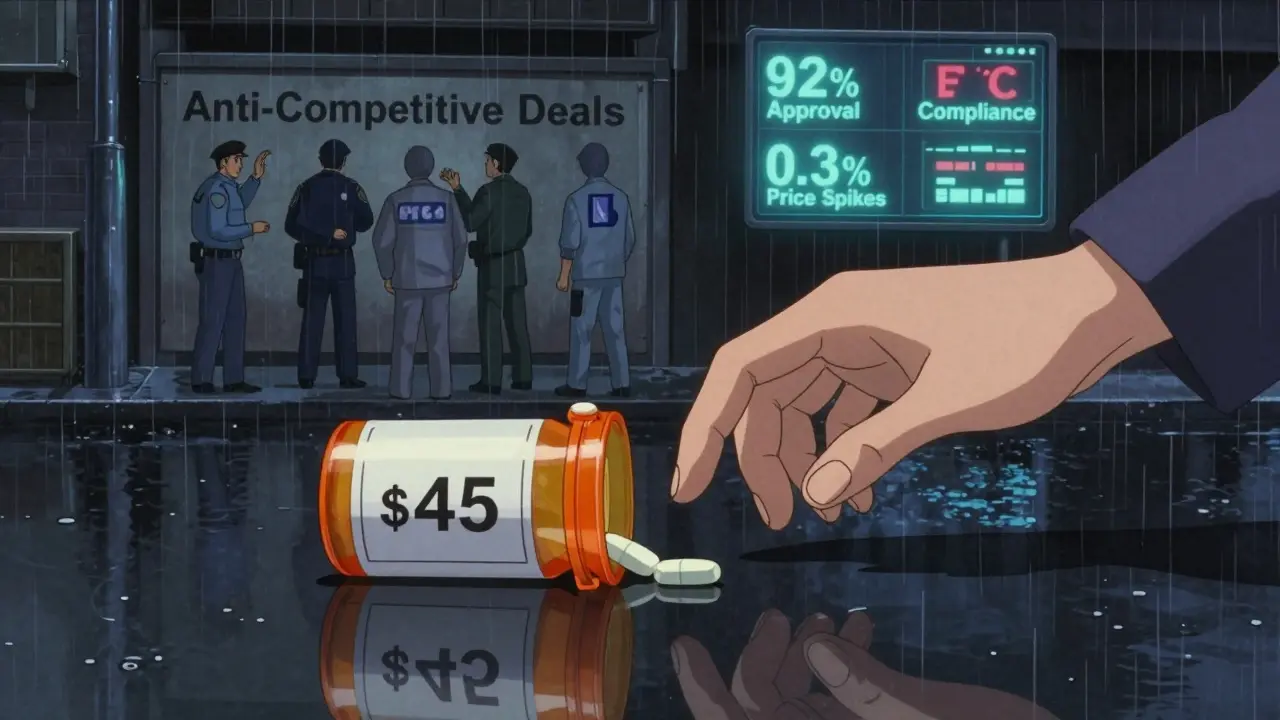

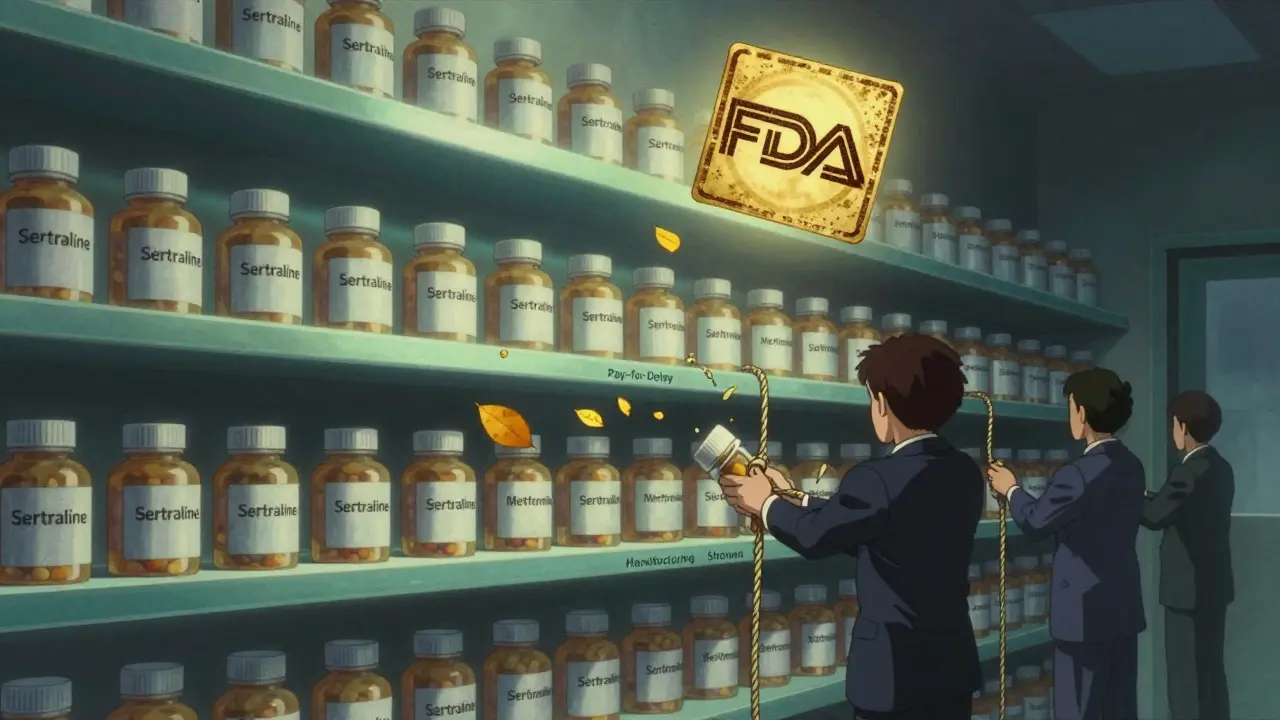

The FDA’s Generic Drug User Fee Amendments (GDUFA), renewed in 2022 with $750 million in industry fees, is a big part of that. Before GDUFA, it took an average of 18 months to approve a generic drug. Now, the goal is 10 months - and they hit 92% compliance in 2023. That means more generics hit the market faster, and prices drop quicker.

But it’s not just about speed. The Federal Trade Commission (FTC) is watching for shady behavior. In 2023 alone, the FTC challenged 37 "pay-for-delay" deals - where brand-name companies pay generic makers to delay launching their cheaper versions. These deals kept drugs expensive for years. The FTC estimates stopping these practices saves consumers $3.5 billion a year.

In January 2024, the FTC blocked the merger between Teva and Sandoz, two of the biggest generic manufacturers, because it would have reduced competition for 13 key drugs. That’s not price control - that’s market enforcement.

Why Some Generic Prices Spike - And Why It’s Rare

You’ve probably heard stories: someone’s generic blood pressure pill jumped from $4 to $45 overnight. It sounds terrifying. And yes, it happens. But here’s the truth: those cases are outliers.

The FDA’s 2023 Drug Shortage Report found that only 0.3% of generic drugs saw price spikes like that. Most of the time, these spikes happen because one manufacturer stopped making the drug - maybe because the price was too low to cover costs. That leaves just one or two suppliers, and suddenly, competition disappears. That’s when prices jump.

That’s why hospital pharmacists report that 18% of them have faced shortages of critical generics. Forty-three percent say manufacturers quit making certain drugs because the price fell below what it cost to produce them. It’s a broken incentive: too much competition drives prices down so far that no one can profit - and then the drug vanishes.

That’s not a failure of the market. It’s a failure of the system to recognize that even generics need a minimum price to stay in business.

How U.S. Generic Pricing Compares to the Rest of the World

The U.S. has the most competitive generic market in the world. On average, there are 14.7 manufacturers for each generic drug here. In Europe, it’s 8.2. In Japan, it’s 5.3.

That’s why Americans pay less for generics than people in other rich countries - even though we pay more for brand-name drugs. The U.S. accounts for 42% of global generic drug volume but only 29% of global generic spending. That’s because competition here is fierce.

Other countries try direct price controls. Canada sets maximum prices. The U.K. uses reference pricing. But those systems often lead to shortages. The U.S. approach - encourage competition, punish collusion, speed up approvals - keeps drugs available and cheap.

What’s Changing in 2025 and Beyond

The FDA’s 2024-2026 Generic Drug Implementation Plan is now focusing on "complex generics" - drugs with tricky formulations, like inhalers or injectables. These take longer to approve, and brand-name companies often use them to delay competition through "product hopping" - tweaking the drug slightly to reset patent clocks.

The FDA created a new submission template in late 2023 to speed up reviews of these complex drugs. Pilot programs showed a 35% reduction in review time. That’s huge for patients who need these medications.

Meanwhile, Medicare is cracking down on prior authorization for generics. In April 2024, CMS proposed rules to stop insurance plans from making patients jump through hoops just to get a $5 generic pill. That could save beneficiaries $420 million a year.

And the GPhA’s Competitive Generic Therapy program gives extra review speed to generics entering markets with too few competitors - a targeted fix for the rare cases where competition hasn’t kicked in.

What Patients Really Think

Most people don’t complain about generic prices. A 2024 KFF survey found that 76% of Medicare Part D users pay $10 or less for their generics. Eighty-two percent say they’re satisfied with how affordable their medications are.

On Drugs.com, 87% of reviews for generic drugs mention "affordable" or "cost-effective" as the top positive point. Only 5% mention pricing concerns.

But when a price spike hits - even if it’s rare - it hits hard. One person’s $45 sertraline bill can ruin their budget. That’s why transparency matters. The FDA launched its Generic Drug User Fee Public Dashboard in October 2023, letting anyone track application status in real time. If a generic is stuck in review, you can see why. That helps patients and pharmacists plan ahead.

Why Experts Say Price Controls Won’t Work for Generics

Dr. Aaron Kesselheim from Harvard Medical School told the Senate Finance Committee in 2024: "Generic drugs have demonstrated the ability to achieve substantial price reductions through competition alone, making additional price controls unnecessary and potentially counterproductive."

The Congressional Budget Office looked at what would happen if they applied international pricing to generics. The result? A $2.1 billion savings - just 0.4% of total generic spending. Compare that to $158 billion in savings from controlling brand-name drugs.

The Academy of Managed Care Pharmacy says outright: "We oppose government regulation of drug pricing... and support the elimination of barriers to competition." They know the system works - if you let it.

The real problem isn’t too much competition. It’s too little in some cases. The solution isn’t price caps. It’s more enforcement, faster approvals, and smarter rules to keep the market open.

What You Can Do

If you’re on a generic drug and your price jumps:

- Check if another pharmacy has a lower price - prices vary wildly between chains and independents.

- Use GoodRx or SingleCare - they often show prices lower than your insurance copay.

- Ask your pharmacist if there’s an alternative generic from a different manufacturer.

- If it’s a critical drug and you’re seeing shortages, report it to the FDA’s Drug Shortage Portal.

And if you’re a patient who relies on generics - know this: the system is designed to keep your meds cheap. It’s not perfect. But it’s working better than almost any other part of the drug market.

Why doesn’t the U.S. government set prices for generic drugs like it does for brand-name drugs?

The government doesn’t set prices for generics because competition already drives them down. Once multiple manufacturers enter the market, prices fall by 80-90% within two years. The Inflation Reduction Act and other price negotiation programs specifically exclude generics because they’re already affordable. Direct price controls could discourage new manufacturers from entering the market, risking shortages.

Can generic drug prices suddenly go up a lot? Why?

Yes, but it’s rare - affecting only about 0.3% of generics. Price spikes usually happen when one manufacturer stops making the drug, leaving only one or two suppliers. Without competition, prices rise. This often occurs when the price falls so low that production becomes unprofitable. The FDA tracks these shortages, and the FTC investigates if a company intentionally exited the market to raise prices.

Are generic drugs less effective than brand-name drugs?

No. The FDA requires generics to be bioequivalent - meaning they deliver the same amount of active ingredient at the same rate as the brand-name drug. Over 99% of generics meet this standard. Studies show no meaningful difference in effectiveness or safety between generics and brand-name versions. The only differences are in inactive ingredients, like fillers or color, which don’t affect how the drug works.

What’s the difference between a generic and an authorized generic?

An authorized generic is made by the original brand-name company but sold under a generic label. It’s identical to the brand drug - same factory, same formula - but priced like a generic. Brand companies use them to compete with other generics, sometimes to delay cheaper competitors from entering the market. The FDA and FTC watch these closely to prevent abuse.

How long does it take to get a generic drug approved in the U.S.?

For standard generics, the FDA aims to approve applications within 10 months. In 2023, they met that goal 92% of the time. Complex generics - like inhalers or injectables - take longer, averaging 18-24 months. The FDA has a special program to speed up these approvals, and manufacturers can apply for Competitive Generic Therapy status if few companies are making the drug.

Why are some generic drugs hard to find in pharmacies?

Shortages happen when manufacturers stop producing a drug because the price is too low to make a profit, or because of supply chain issues. The FDA tracks these shortages and works with manufacturers to restart production. If a drug is critical and unavailable, your pharmacist can often source it from another supplier or suggest a therapeutic alternative.

Do Medicare Part D plans charge the same for all generic drugs?

No. Medicare Part D plans negotiate rebates with drug manufacturers. Preferred generics - those with the lowest cost - often have $0 or $5 copays. Non-preferred generics can cost $10-$40. Plans may also require prior authorization for certain generics, but new CMS rules aim to stop that practice to save patients money.

Is it true that generic drug companies are making less money now?

Yes, for many. The intense competition has driven down prices so far that some manufacturers - especially smaller ones - can’t make a profit on certain drugs. This has led to fewer companies making generics, and some drugs disappearing from the market. The FDA and FTC are trying to fix this by speeding up approvals and cracking down on anti-competitive behavior, but the business model for generics is under pressure.

Kunal Kaushik

Just took my generic metformin this morning - $3 at my local pharmacy. 🙌 I’m from India, and honestly, this system is why I can afford my meds. No drama, no drama - just science and competition working.

Caleb Sutton

They’re lying. This is all a front. The FDA is in bed with Big Pharma. The real reason generics are cheap is because they’re made in China with substandard ingredients. You think your blood pressure pill is safe? Think again.

Jamillah Rodriguez

Ugh. I read like 3 paragraphs and then my brain shut off. Can we just make everything free? Why does it have to be so complicated? I just want my pills to not cost more than my coffee.

Susheel Sharma

Let’s not romanticize market forces. The 0.3% price spikes? Those aren’t outliers - they’re systemic failures masked as anomalies. When a single manufacturer controls 80% of the supply for a critical drug, that’s not capitalism - that’s monopoly capitalism with FDA approval. The system isn’t broken; it’s designed to fail quietly.

And yes, I’ve seen the GPhA reports. The Competitive Generic Therapy program? It’s a PR stunt. They don’t prioritize drugs that matter - they prioritize drugs with the highest profit potential after exclusivity. It’s predatory altruism.

Meanwhile, patients are left scrambling. I know someone who had to switch from sertraline to fluoxetine because the price jumped from $4 to $47. No one in Congress blinked. Not even a tweet.

The real villain isn’t the manufacturer who quit - it’s the regulatory capture that lets them leave without consequence. The FTC’s 37 pay-for-delay challenges? A drop in the ocean. We need structural reform, not incremental tweaks.

And don’t get me started on authorized generics. That’s not competition - it’s a Trojan horse. Brand companies use them to dilute market entry, not enhance it. The FDA knows this. They just don’t care enough to act.

Janice Williams

You’re all naive. This isn’t about competition - it’s about control. The government allows generics to be cheap so that people don’t realize how much they’re being exploited elsewhere. It’s a psychological trap. If you think you’re saving money on pills, you’ll never notice the $800 co-pay on your insulin. This is psychological warfare disguised as healthcare policy.

Roshan Gudhe

There’s a quiet beauty in how this system works - not because it’s perfect, but because it’s human. It doesn’t rely on grand decrees or bureaucratic fiat. It relies on people - scientists, pharmacists, small manufacturers - showing up every day to make a pill that works, at a price someone can afford.

It’s messy. Sometimes it fails. But it’s not broken. It’s alive.

I’ve watched my uncle in Delhi buy his generic amlodipine for $0.20 a tablet. He doesn’t know about ANDA applications or GDUFA timelines. He just knows his heart is okay. That’s the real metric.

We’re so obsessed with systems and policies that we forget: medicine isn’t about regulation. It’s about dignity.

Maybe the answer isn’t more rules. Maybe it’s more trust - in the process, in the people, in the quiet, stubborn fact that when you let competition breathe, it finds a way.

Not always fast. Not always fair. But often enough.

Rachel Kipps

i think the fda is doing a good job but i also think we need more transparency about why some drugs are hard to find. like, why does one company stop making it? is it the price? or is there a supply chain issue? no one ever says.

Katherine Urbahn

It is imperative to note, with utmost clarity, that the absence of direct price controls does not equate to a laissez-faire utopia. Rather, it represents a carefully calibrated, multi-agency regulatory architecture - one that employs antitrust enforcement, user fee funding, and expedited review protocols to achieve market-driven affordability without state intervention. To conflate this with "free market" rhetoric is not only inaccurate - it is intellectually irresponsible.

Furthermore, the claim that generics are "cheaper than in other countries" is misleadingly contextualized. The U.S. consumes 42% of global generic volume because it is the only major economy that permits direct-to-consumer advertising, which artificially inflates demand - and thus, production volume - while simultaneously suppressing price transparency. This is not a virtue. It is a distortion.

Moreover, the FDA’s 92% compliance rate with 10-month review timelines is statistically significant - but it is not a moral achievement. It is a performance metric. The fact that 8% of applications still languish beyond 18 months - often for life-saving medications - is not a footnote. It is a scandal.

And yet, we celebrate this system as if it were flawless. We must not confuse efficiency with justice.

Joy Johnston

As a pharmacist for 18 years, I can tell you: the system works - but only if you know how to use it. Most patients don’t know about GoodRx. They don’t know that Walmart’s $4 list is often cheaper than their insurance. They don’t know that switching manufacturers can drop a $45 pill to $7.

I’ve had patients cry because they thought they couldn’t afford their meds. I show them my phone. They’re stunned. It’s not the system’s fault. It’s the lack of education.

Also - if your pharmacy won’t tell you about alternatives, find a new one. Pharmacies are businesses. They don’t always push the cheapest option. But you can.

And yes, I’ve seen shortages. I’ve called manufacturers. I’ve begged. Sometimes, they answer. Sometimes, they don’t. But we keep trying. Because people need these pills.

It’s not perfect. But it’s not broken. It’s just… underused.

Shelby Price

Wait, so if competition drives prices down, why do some generics cost $50? I thought that was impossible? Like… how does that even happen? Is it just bad luck? Or is there something else going on?

Jesse Naidoo

Did you know that the same company that makes your generic metformin also owns the patent on the brand? Yeah. They’re playing both sides. You think you’re saving money? You’re just paying them less. They’re still getting rich.

Keith Harris

You’re all delusional. This isn’t about competition - it’s about the government letting Big Pharma write the rules. The FDA approves generics faster because they’re owned by the same conglomerates that make the brand drugs. The "competition" is fake. It’s a shell game. You think you’re getting a bargain? You’re just getting a different logo on the same pill.

And don’t even get me started on the FTC. They only challenge pay-for-delay deals when the media catches wind. Otherwise? Silence. They’re paid to look busy, not to fix anything.

Real reform? Ban corporate ownership of generics. Force spin-offs. Break up the monopolies. But no - we’d rather pat ourselves on the back for a 92% approval rate.

Alec Stewart Stewart

My grandma takes three generics. All under $5. She doesn’t know what ANDA means. She just knows she can afford it. That’s all that matters. Keep it simple. Keep it cheap. Don’t overthink it.

Demetria Morris

I’m glad someone finally said it - the system works… until it doesn’t. And when it doesn’t? You’re left alone with a $45 bill and no one to blame. That’s not freedom. That’s abandonment.

Geri Rogers

YES. This is why I became a pharmacist. I’ve seen people choose between food and their meds. I’ve had to tell a single mom she can’t afford her insulin - and then found her a $3 generic alternative at a different pharmacy. This system? It’s not perfect. But it’s the closest thing we have to justice. Keep pushing for faster approvals. Keep exposing pay-for-delay. Keep fighting. We’re winning.